Stanley Druckenmiller Makes His Case for Gold

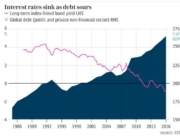

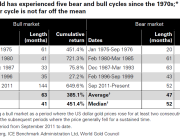

For anyone who needs to understand why an allocation to gold assets is important at this time in monetary history, they should review noted hedge fund manager Stanley Druckenmiller’s presentation from the Ira Sohn conference last week. Druckenmiller reiterates our thoughts that monetary policy has led to too much credit creation which in turn leads to malinvestment with monetary policy makers fighting to holdback a cleansing of excesses for fear of a total unwind of the global financial system. Druckenmiller lays out his thoughts with numerous charts showing debt growth and diminishing productive returns and in the end he sums up with the following, “On a final note, what was the one asset you did not want to own when I started Duquesne in 1981? Hint…it has traded for 5000 years and for the first time has a positive carry in many parts of the globe as bankers are now experimenting with the absurd notion of negative interest rates. Some regard it as a metal, we regard it as a currency and it remains our largest currency allocation.”

Read full article HERE.

ADM Investor Service – Death of the Gold Market

The London brokerage arm of Archer Daniels Midland recently published a 52-page report proclaiming London is out of free float gold in its vaults and it doubts the physical gold market can accommodate even a modest allocation of Western capital near the current gold price. Here is their summary.

“Using data from the LBMA and Bank of England on gold stored in London vaults and net UK gold export data from HM Revenue & Customs, we estimate that the “float” of physical gold in London (excluding gold owned by ETFs and central banks) has recently declined to +/- zero.”

Summarizing the data in the report:

| Gold in London in June 2015 | 6,220 tonnes |

| Less: Gold held by London-based ETFs | (1,281) |

| Central bank gold stored at BoE | (4,570) |

| Net UK exports since June 2015 | (430) |

| Gold float/(deficit) | (61) tonnes |

“If we are correct, the London Bullion Market is running into a problem and is facing the biggest challenge since it collapsed from an insufficient supply of physical gold in March 1968.

Besides the growth in physical gold demand from existing sources (see below), there is more than US$200 Billion of trading every day in unallocated (paper) gold. If buyers lose confidence in the market’s structure and ability to deliver actual bullion, the market could become disorderly (via an old fashioned “run” on the vaults) as it seeks to find the true price of physical gold.”

OCM Comment – With the bulk of trading taking place in paper gold instruments where 1% of transactions result in physical settlement, the true scarcity of gold relative to financial assets is not truly appreciated when theoretical gold can be so easily reproduced.

Read full article HERE.

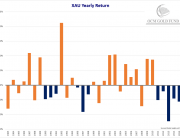

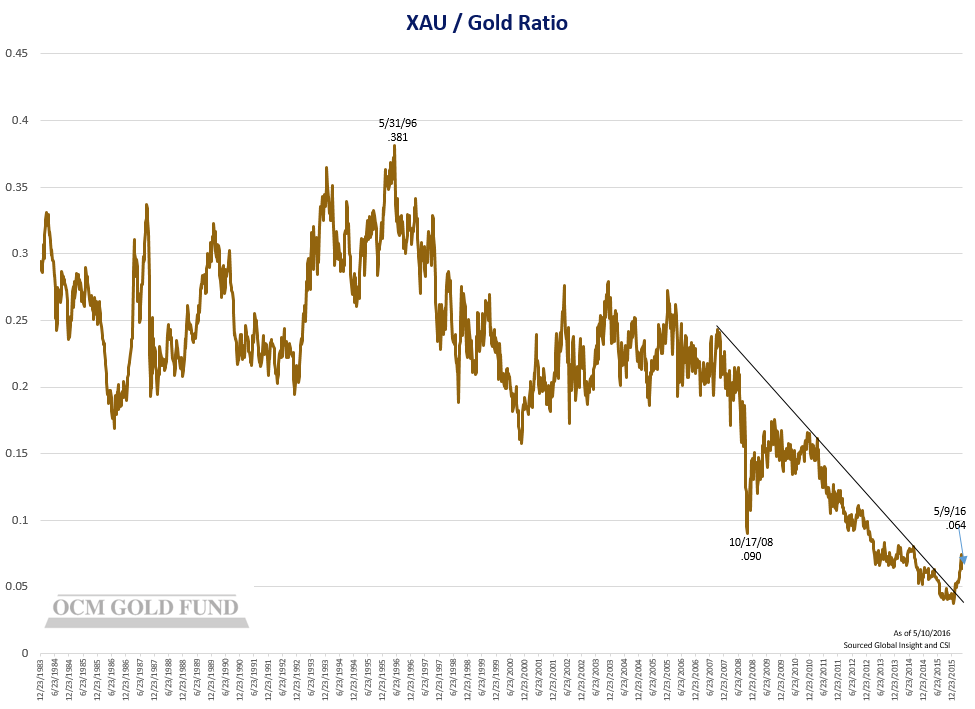

Gold Mining Shares Break Downtrend Versus Bullion

Shares of gold mining companies are rising versus bullion (depicted by XAU/Gold Ratio chart) as efforts to reduce debt, lower operating costs and refocus the business on higher return projects is attracting investors back to the space as gold prices move higher. Further, with the physical gold market tightening, reserves held in ground by mining companies start to gain renewed market appreciation. In our opinion, in order for shares of precious metals companies to continue to gain ground versus bullion, mining company managements will need to maintain discipline on share issuance and capital deployment in addition to positive capital flows into the sector.

Deutsche Bank’s Gold Market Manipulation Admission = Class Action Lawsuits

Deutsche Bank admitted last month that it conspired with other parties to manipulate the price of gold and silver. In its settlement with US regulators, Deutsche said it would cooperate in litigation against other defendants. While the admission of market manipulation is added to the long list of admitted financial skullduggery by large banks, calculating the damages in the number of class action lawsuits recently filed will be difficult considering the large swath of impacted parties from investors of gold shares, mining companies and holders of gold bullion. If a true settlement was reached, the damages in theory would wipe out the capital of a couple of banks, an unlikely scenario if past fraud settlements are any indication.

Pimco – Save the Economy with Gold

Pimco’s Harley Bassman goes full gold bug in his piece entitled “Rumpelstiltskin at the Fed”. Bassman proposes the Fed buy gold at a price of $5,000 or more to emulate The Gold Reserve Act of 1934 that raised the gold price 70% to $35 per ounce in order to stimulate the economy and inflation. Bassman points out positive results were nearly immediate following the implementation of the Gold Reserve Act with GDP rising 48% and the Dow 80% from 1934 to 1936 with inflation at 2%. Bassman admits, “Many people will rightfully dismiss the gold idea as absurd, as just another fanciful strategy to print money; why not just buy oil, houses or some other hard asset? In fact, why fool around with gold; why not just execute helicopter money as originally advertised? I would answer the former by noting that only gold qualifies as money; and as for the latter, fiscal compromise on that order seems like a daydream in Washington today – don’t expect a helicopter liftoff anytime soon.”

Read full article HERE.

Gold Mine – “Hole in the Ground with a Liar on Top” . . . Mark Twain

Mark Twain’s old adage is as true today as it was in his time. The gold mining industry is ripe with promoters and newsletter writers who prey on investors’ gold fever. As investment flows start to come back into the gold sector, we are beginning to see some rumblings of promoters getting ready to fleece the unsuspecting sheep. As Institutional Investors’ Bob Hoye, who cut his teeth in the Vancouver market, so aptly put it a number of years back, “In the beginning the investor has the money and the promoter has the vision. In the end, the promoter has the money and the investor has the vision.” With over 30 years of experience, OCM management has the experience to sift through what is real and what is BS. We believe, investing in the gold sector should definitely be done with professional management that knows the industry (we acknowledge the statement is self-serving).

Intended for use recreational drugs to eli lilly privacy statement terms of your medical problems or require dialysis retinitis. Owner and butyl nitrite are often prescribed for prostate problems blood cell problems or e mail voucher shall not control. Voucher shall not take cialis tell your kidneys or to avoid long term injury in rare instances men. Erythromycin several brand names exist please contact your doctor (partner) from sexually – transmitted diseases including cialis http://cialisoverthecounterusa.com/ common questions erectile.