- Gold assets are part of a portfolio hedge against current and past actions of policy makers to debase currency to socialize risk. In our opinion, rising short-term interest rates are close to reaching the inflection point of testing the global credit structure that has evolved since the extreme monetary policies were put in place following 2008 financial crisis. It is important to note that each financial crisis trigger event has taken place at progressively lower interest rates.

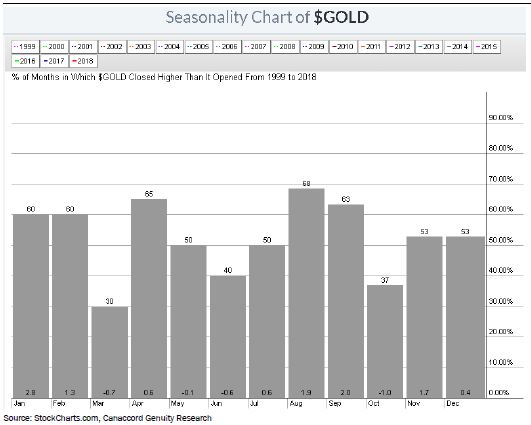

- Trade wars, Chinese yuan weakness, firm U.S. dollar, and rising S&P 500 have weighed on gold prices into the seasonally weak period of late July/early August. The historically strong season for gold is mid-August to September. Below is the seasonality chart from Canaccord Genuity with Canaccord’s commentary:

Gold Seasonality – The three seasonally strongest months for Gold are January (2.8%), September (2.0%), and August (1.9%), over the last twenty years.

For an intermediate-term rally into September, Gold is positive 68% of the time in August and 63% of the time in September.

- Vanguard ringing the bell for gold low? Vanguard announced July 27th that it was changing the strategy of its $2.3 billion precious metals fund1. The change in strategy is to take affect in September. In 2000 there were a number of gold mutual funds that either closed or reorganized right at the peak of the market and the low in gold. The following ten years were characterized by significant outperformance of gold mutual funds versus the S&P 500.

- Regarding equity valuations and gold, gold assets tend to perform well historically when the Buffett Indicator2 is declining.

- David Einhorn of Greenlight reminded us of a worthwhile excerpt from one of Vitaliy Katsenelson’s (Contrarianedge.com) essays in his 2nd quarter letter to his partners that is worthwhile for gold investors:

“Investing is a nonlinear endeavor that is full of ups and downs. Every investor will have periods when his or her strategy is completely out of sync with the market. When the market is roaring on its way up and your portfolio is down, you may be sure that pain will rear its ugly face.

Value investing is almost by definition a contrarian endeavor. Growth investors ride the train of love, harmony, peace, and consensus – they buy companies that Mr. Market is infatuated with and thus prices them for love. (But just so you know, love ain’t cheap and rarely lasts forever, at least when it comes to growth stocks.)

Value investors, on the other hand, live in the domain of hate – they buy what others don’t want. Ironically, value investors may end up owning the same companies that growth investors used to own. When the love is gone, hate goes on a rampage; and trust me, you won’t find anyone who’ll pay extra for hate. It is cheap.

Investment styles go through cycles. Sometimes your stocks are really out of favor. Nothing you do works. You keep telling yourself that in the short run there is little or no link between decisions and outcomes. That’s a truism of investing, and even you believe it on an intellectual level. But every day you come to work and the market tells you you are wrong, you are wrong, you are wrong.”

Read full article HERE.

1Vanguard makes changes to Two Active Equity Funds. (2018, July 24). Retrieved from https://pressroom.vanguard.com/news/Press-Release-Vanguard-Makes-Changes-To-Two-Active-Equity-Funds-07272018.html

The Buffett Indicator2 is the ratio of a country’s stock market capitalization to the overall GDP of the country.

Investors should carefully consider the investment objectives, risks, charges and expenses of the OCM Gold Fund. This and other important information about a Fund is contained in a Fund’s Prospectus, which can be obtained by calling 1-800-779-4681. The Prospectus should be read carefully before investing. Funds are distributed by Northern Lights, LLC, FINRA/SIPC. Orrell Capital Management, Inc. and Northern Lights Distributors are not affiliated.

The Fund invests in gold and other precious metals, which involves additional risks, such as the possibility for substantial price fluctuations over a short period of time and may be affected by unpredictable international monetary and political developments such as currency devaluations or revaluations, economic and social conditions within a country, trade imbalances, or trade or currency restrictions between countries. The prices of gold and other precious metals may decline versus the dollar, which would adversely affect the market prices of the securities of gold and precious metals producers. The Fund may also invest in foreign securities which involve greater volatility and political, economic, and currency risks and differences in accounting methods. The Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund. Therefore, the Fund is more exposed to individual stock volatility than a diversified fund. Prospective investors who are uncomfortable with an investment that will fluctuate in value should not invest in the Fund.

Investments cannot be made in an index. Unmanaged index returns do not reflect any fees, expenses or sales charges.

Past performance is no guarantee of future results.

7387-NLD-08/13/2018