Dash for Cash………….

Last week saw gold prices suffer under the weight of traders and investors closing out profitable positions and liquidating gold positions to cover margin calls as oil and the S&P 500 experienced outsized moves that typically trigger margin calls for leveraged investors. For the past year gold prices have been rising into this event, almost as if the gold price anticipated some type of Black Swan event. While it may seem counter-intuitive for gold prices to decline in a financial crisis, there is no doubt the market has suffered liquidity issues and stress over the past week that would have precipitated the need to raise cash and lower exposure among large hedge funds and trading desks. Systemic risk, perceived or real, is sometimes associated with lower gold prices initially.

In our opinion, this is the prelude to the next leg higher in the bull market in gold as zero/negative rates and Federal Reserve balance sheet expansion through asset purchases (Quantitative Easing or QE) act as tailwinds. Gold has been hitting new all-time highs versus many currencies which we believe supports our view that gold is in a fundamentally strong bull market.

Interestingly, bullion dealer Bullion Star, stated over the weekend that it was doing brisk business and is sold out of most bullion coin products.

As Expected, Federal Reserve Brings Out Monetary Bazooka…..Slashes Rates to Zero Plus QE

Left with no choice in an effort to avoid financial market Armageddon, the Federal Reserve on Sunday announced it was cutting the Federal Funds Rate to Zero and embarking on a $700 billion asset purchase program. The big questions that no one knows the answers to at this time – Will it be enough? Are negative interest rates on the horizon in the United States? Is the Coronavirus the domino that sets off a sequence of defaults that leads to the collapse of the great credit build-up since the 2008 Great Financial Crisis? Is this the beginning of the end of the current monetary system? At what point might we see panic buying of gold assets?

Once the Dust Settled 2008….

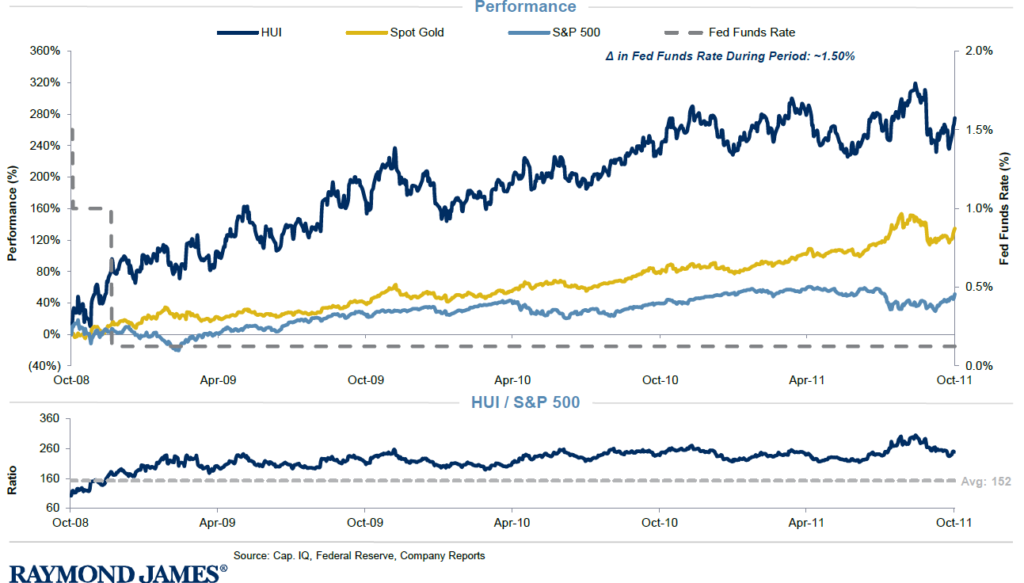

While the decline in gold, silver and precious metals equity prices harkens back memories of 2008 price action, the aggressive fiscal and monetary response following may give us a road map and some comfort to where gold prices and precious metals equities may be heading. The following from Raymond James – “From the financial crisis in 2008, gold and gold equities outperformed the market over the next two years.”

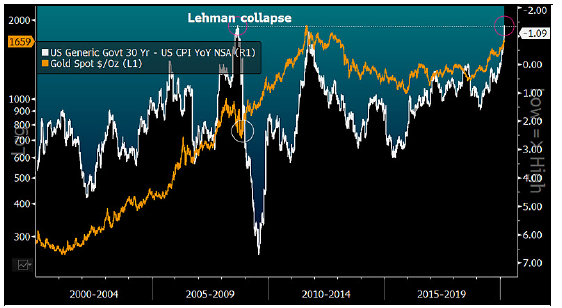

Negative Real Yield Staying Power This Time

Mike McClone of Bloomberg Intelligence commented on 3/12/20 regarding gold prices being helped by negative real yields, like 2008: “The plunge in U.S. Treasury real yields is akin to the financial crisis and more supportive of gold prices this time, in our view. A primary difference from 12 years ago is that negative real yields have more potential staying power on the back of negative rates in Europe and Japan. Our graphic depicts the similarities between March 9 and September 15, 2008 when Lehman Brothers collapsed: The U.S. 30-year yield less CPI bottomed at about minus 130 bps as the gold rally accelerated. In 2008, German and Japanese 10 notes yielded about 4% and 1.5%, respectively. Now they’re closer to minus 0.8% and negative 0.1%. Extremely low and negative yields are gold price tailwinds.”

Investors should carefully consider the investment objectives, risks, charges and expenses of the OCM Gold Fund. This and other important information about a Fund is contained in a Fund’s Prospectus, which can be obtained by calling 1-800-779-4681. The Prospectus should be read carefully before investing. Funds are distributed by Northern Lights, LLC, FINRA/SIPC. Orrell Capital Management, Inc. and Northern Lights Distributors are not affiliated.

The Fund invests in gold and other precious metals, which involves additional risks, such as the possibility for substantial price fluctuations over a short period of time and may be affected by unpredictable international monetary and political developments such as currency devaluations or revaluations, economic and social conditions within a country, trade imbalances, or trade or currency restrictions between countries. The prices of gold and other precious metals may decline versus the dollar, which would adversely affect the market prices of the securities of gold and precious metals producers. The Fund may also invest in foreign securities which involve greater volatility and political, economic, and currency risks and differences in accounting methods. The Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund. Therefore, the Fund is more exposed to individual stock volatility than a diversified fund. Prospective investors who are uncomfortable with an investment that will fluctuate in value should not invest in the Fund.

Investments cannot be made in an index. Unmanaged index returns do not reflect any fees, expenses or sales charges.

Past performance is no guarantee of future results.

HUI Index also known as gold BUGS index is the NYSE Arca’s index measuring gold companies that do not hedge their gold production beyond a year and a half.

NLD Code: 2121-NLD-3/17/2020